RBA Recap

- Incoming RBA Governor Michelle Bullock continued the status quo by maintaining the cash rate during her first meeting, as expected.

- The October statement closely resembled the previous one, offering little new information on the central bank’s future.

- The RBA will closely monitor various economic indicators, including inflation, employment, sentiment, retail sales, and lending data, with November’s meeting potentially becoming significant based on upcoming CPI figures.

The Australian Economy

- Mixed inflation with some upward pressure, weak retail sales, and easing price pressures in business conditions suggest no immediate RBA policy change for November.

- Ongoing Middle Eastern crises are causing global market volatility due to uncertainty about sovereign yields and oil prices.

- RBA is closely monitoring economic trends and prefers a soft landing approach, preserving workforce gains rather than raising rates in response to any potential demand uptick.

Market Dynamics

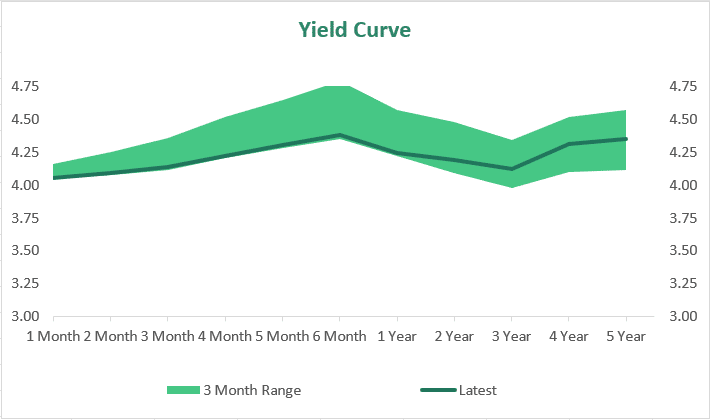

- Term Deposit markets have experienced short-term rate stability and volatility in 3-5 year longer-term rates.

- Funding dynamics have been stable, but isolated factors like banks missing funding targets may offer opportunities as the year ends. Domestic banking remains robust thanks to strong capital and prudential standards.

Please click here to download the October Monthly