RBA Recap

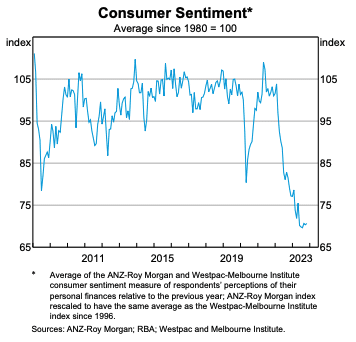

- The Reserve Bank of Australia raised interest rates by 25 basis points at its November meeting, bringing the cash rate to 4.35%, the highest in a decade.

- The decision was influenced by stronger-than-expected economic data, particularly Q3 inflation, which exceeded RBA’s forecasts, leading to a revision in their inflation projections.

- The RBA’s shift in bias indicates a more balanced outlook on tightening monetary policy, suggesting they are focused on achieving the target inflation rate within a reasonable timeframe, potentially until the end of 2025.

The Australian Economy

- Tightness in the labour market and bleak per capita retail sales continues this month.

- Q3 domestic inflation exceeded expectations, leading to a November rate hike and a recalibration of RBA forecasts.

- Looking ahead domestic economic activity is expected to be supported by population growth, private and public investment, and fiscal policy.

Market Dynamics

- Demand for funds in the banking system has been quiet, but in the past month, there’s been reversal to this trend with banks actively seeking funds in the wholesale space.

- The motivation behind this increased demand is unclear, but it could be banks bolstering liquidity ahead of the holiday period to avoid higher rates later.

- Term deposits have provided generous returns, peaking at 5.70% for a 5-year term deposit. After the RBA hike, the yield curve has recalibrated, and investors have been locking in elevated longer term rates as market commentators call the ‘peak’ of interest rates.

Please click here to download the November Monthly