RBA Recap

- Monetary policy in 2023 involved a series of rate hikes, totalling 13 and amounting to 425 basis points in 19 months, impacting the economy significantly.

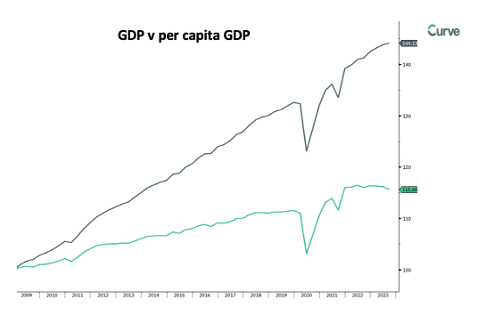

- Despite per capita GDP experiencing a recession and the household savings ratio dropping to its lowest level since the GFC at 1.1%, the overall economy benefited from a growing population, mainly due to post-pandemic net migration catch-up.

- The upcoming year is anticipated to be a struggle between the declining per capita economy and the compensating force of population growth.

The Australian Economy

- RBA’s decision to maintain interest rates at 4.35% in December was supported by data revealing a significant economic slowdown in Q3, marked by minimal GDP growth.

- Despite retail sales falling and household discretionary spending declining, the impact of surging immigration masked the per capita spending decrease.

- Consumer confidence, although showing a slight increase, remains at its second-lowest level in 50 years, suggesting tough times ahead for the Australian economy in 2024.

Market Dynamics

- Demand for funds in the banking sector has increased in mid-November and continued into December, driven by the desire for robust liquidity buffers during the holiday season.

- Changes in liquidity standards may lead to a shift from traditional bank-to-bank transactions to non-bank funding counterparties, especially with a growing emphasis on ESG-friendly investments.

Please click here to download the December Monthly