RBA Recap & The Australian Economy

- The RBA took the markets by surprise with a 25 basis point hike at its May Meeting, taking the cash rate to 3.85%.

- The goal to return inflation to target within a “reasonable timeframe” seems like it will be a prominent theme for the RBA over the months ahead.

- What constitutes a reasonable timeframe and how is Australia currently tracking?

- Unemployment remains at historical lows with a trend in the dominance of full-time roles vs part time roles.

- With services inflation proving sticky, the consumption behaviour of consumers will be a key influence on future monetary policy.

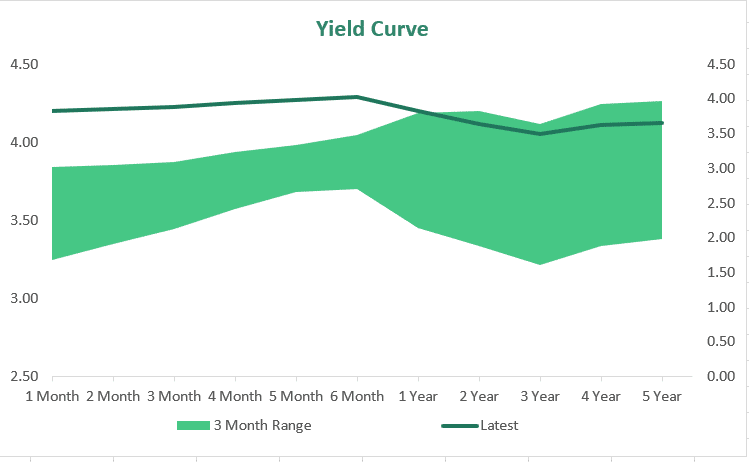

Market Dynamics

- Uncertainty has reduced since the collapse of SVB and overseas liquidity concerns.

- A rise in outright term deposit and NCD rates has been driven by markets repricing after the RBA hike and a recent pick up in the demand for funds.

- It will be interesting to see if the repayment of TFF will increase ADI’s appetite for longer term.

Please click here to download the May Monthly