RBA Hangs in The Balance

- RBA’s recent meeting signalled a shift to fewer gatherings per year, emphasising a streamlined communication approach.

- Despite leaving the cash rate unchanged, RBA’s focus remains on balancing risks, particularly regarding inflation and economic growth.

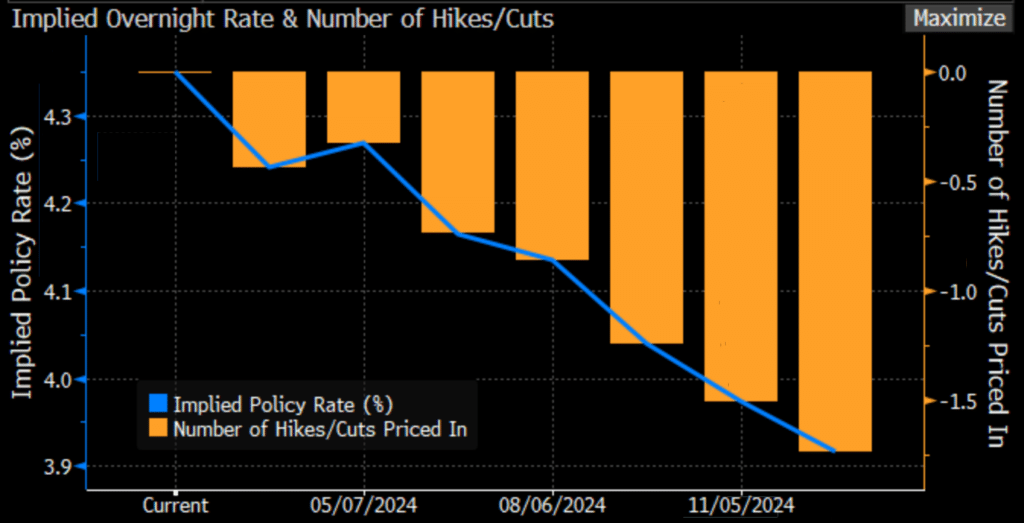

- Monetary policy outlook hinges on data evolution; while a rate cut is anticipated, RBA is cautious and may delay until confidence in inflation targeting is stronger.

The Australian Economy

- Economic activity remains persistently soft, with Australians experiencing strained household incomes due to high inflation, tight monetary policy, and increased tax payments.

- Retail sales saw a significant decline in December, with a minimal increase in the last quarter of 2024 largely attributed to holiday sales discounts, resulting in a -1% decrease in real retail sales for the year.

- Overall, the RBA can find solace in signs of an easing labour market and inflation falling more rapidly than expected but the path ahead is narrow with risks present on both sides.

Please click here to download the February Monthly