RBA Recap

- RBA lifted interest rates due to supply-demand imbalance, but now, aggregate demand is weakening, and they can pause to assesses risks to the outlook.

- Households will feel the pressure over the next year as demand needs to fall further for price stability to return.

- Based on the balances of risks to the outlook, the burning question remains, what does it mean for the outlook on monetary policy?

The Australian Economy

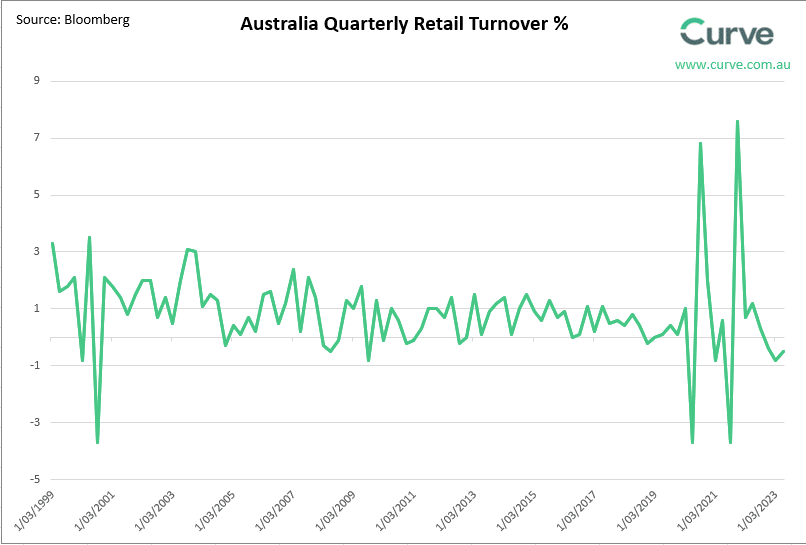

- Lagging monetary policy starts impacting the Australian economy with lower inflation and reduced imports.

- The quarterly inflation print may signify a turning point in the economy as restrictive monetary policy starts to be reflected in the data.

- Looking forward the question markets will be asking is whether the RBA will be able to pull off the Goldilocks soft landing.

Market Dynamics

- The last financial quarter had uncertainty due to overseas banking concerns and high fund demand.

- Current quarter sees a decreased demand for funds potentially driven by supply from retail deposits and slowing credit growth.

- Interest rate movement shows shifts in market sentiment, reduced credit margins, and potential yield curve flattening due to changing inflation expectations.

Please click here to download the August Monthly