RBA Recap

- The RBA’s September meeting marked Governor Philip Lowe’s departure, signalling a new era for monetary policy.

- The cash rate remained unchanged for the third consecutive month, indicating a return to normality after significant policy adjustments over the past years.

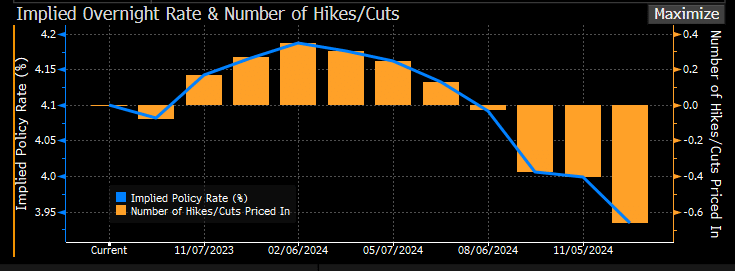

- There is considerable uncertainty among economists regarding the cash rate’s trajectory, with a wide range of expectations, spanning from 3.10% to 4.85% for the next 12 months.

The Australian Economy

- Monetary policy’s lagging impact is affecting Australia’s economy, with peak inflation behind and multiple indicators reflecting economic softening.

- Wage growth is controlled, with higher salary reviews but no wage spiral expected to drive up labour costs and inflation.

- GDP per capita is in recessionary territory but the economy is still growing with reliance on population growth and government spending to sustain momentum.

Market Dynamics

- Financial market stability persists with steady demand and steady asset growth.

- The Term Funding Facility (TFF) repayment period has reduced ESA balances, but most banks pre-funded so effect on liquidity stress has been minimal.

- Interest rates have been less volatile, reflecting stable economic data and a gradual flattening of the yield curve. Market expectations suggest that the cash rate has peaked, causing the spread between short and long-term rates to narrow.

Please click here to download the September Monthly