RBA Recap

- The RBA finally takes a break, signifying a swift turn around from the past 3 months.

- It remains that households have yet to fully feel the pinch of all rate hikes.

- A pause in hikes was seen as nessecary to allow the lagging effects to take place.

- The RBA updated forecasts, in light of revised cash rate market pricing, will reveal the path ahead.

The Australian Economy

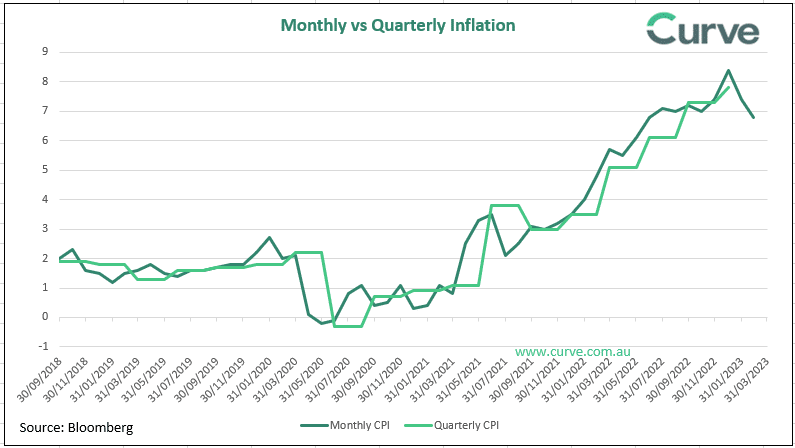

- This months data provided insight into the overall health of the economy with two data points directly related to their mandate of price stability and full employment.

- The RBA decision to pause has seen consumer sentiment rise, how will this impact inflation going forward?

Market Dynamics

- This month started off with global liquidity concerns spooking investors and regulators.

- However, it revealed that Australia’s banking system remains robust.

- As the yield curve begins to flatten, the ability to lock in elevated returns becomes increasingly sparse. Investors are beginning to favour longer term to utilise any steepness remaining in the curve.

Please click here to download the April Monthly