Daily Flows

- With the NAB 3mBBSW+93/3.25% 26/09/2023 maturing soon, market participants have been rolling funds into new securities.

- The recent issuances from Westpac and CBA gathered significant flow, with both issuances trading just below par in the secondary market.

- A 2 year BOQ fixed coupon bond is trading at 5.20% in the secondary market. Investors have been taking advantage of this offering. It is a liquid investment trading at the same rate as term deposits.

Hawkish Pause In The U.S. Moves Interest Rate Expectations

- This morning the FOMC maintained the fed funds rate at a range of 5.25% to 5.50%.

- The FOMC delivered the pause with a hawkish bias, with their ‘dot plot’ projections signalling a hike is plausible.

- 12 out of 19 committee members supported the notion of raising rates later in the year.

- The median for interest rate projections by the FOMC members increased to 5.1% from 4.6%, supporting the narrative of ‘higher for longer’.

- It seems the FOMC is ready to pull the trigger on another hike if inflation does not decelerate at their desired pace.

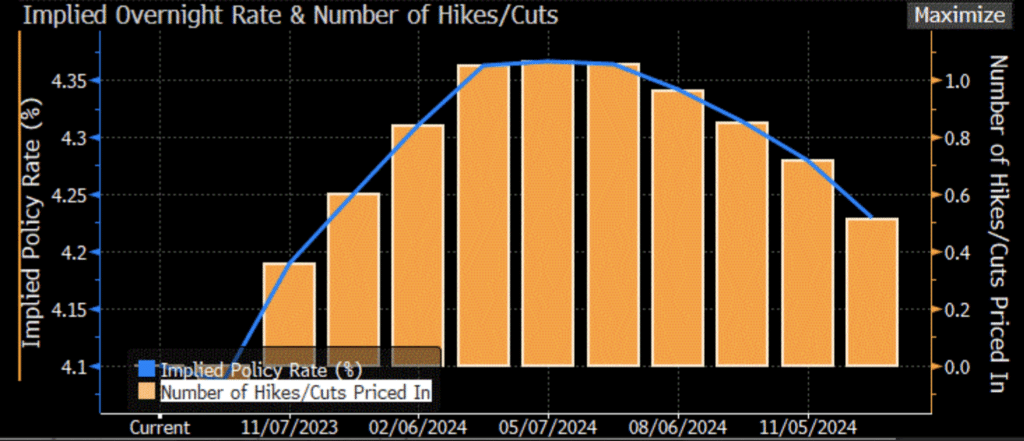

- Domestically, this hawkish sentiment saw the futures markets react, pricing in a hike by the RBA by May 2024.