Daily Flows

- Last Friday was quiet across the NCD and TD space.

- Those that were active gravitated towards the 1 year space, with an ‘A’ rated bank offering 5.46% 1 year TD.

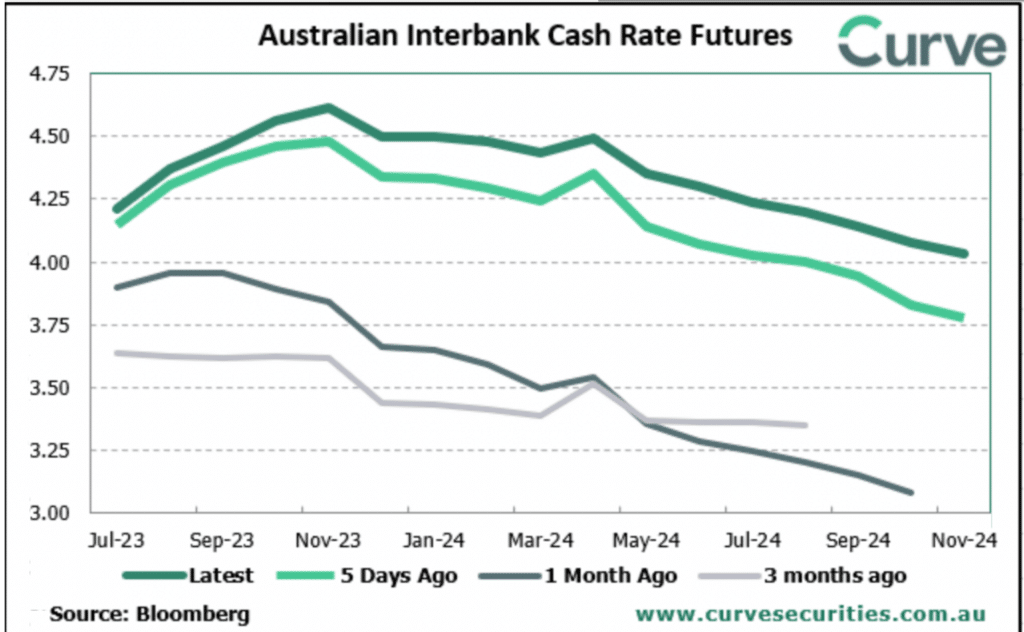

- With economists now forecasting 1-3 more hikes in the cash rate, significant upward pressure will be placed on shorter term deposits.

- NCD margins held firm at +50 for 3 months last Friday.

Quiet Week Ahead

- Compared to last week, it is a relatively date quiet week ahead.

- Tomorrow, the RBA Minutes are released. The markets will look for any clues in regards to future monetary policy decisions.

- Overseas, The United Kingdom inflation rate is printed. Markets are expecting a YoY reading of 8.4% a considerably higher level compared to the EU & U.S.

- The Bank of England will meet on Thursday to make a decision on monetary policy.

- In The U.S. Jerome Powell has a testimony before the House Financial Services Committee.

- It is expected that he will restate similar rhetoric to the Post-Fed meeting press conference.